Covering against the cost of temporary interruption to business activities

Business Interruption (BI) should be an essential part of your business insurance protection to provide cover against both loss of income and additional expenses you incur in the event your business suffers a temporary interruption due to an insured incident.

However, it can be complicated. There are many different options and types of cover available and the key is to select the right cover suited to your business. If not, things can go wrong when a claim occurs.

The Common Problems

Underinsurance

- The sum insured is insufficient – there is often a misunderstanding of how to calculate the correct figure, but also failure to project far enough forward. The fact that the accountancy definition of Gross Profit differs from the insurer’s definition for many businesses doesn’t help! (how to calculate the correct figure)

- The Indemnity Period (the period insurers will pay your losses following the event that gave rise to the claim) is not long enough – It is easy to underestimate the time it will take to get your business fully back up and running in the event of a serious incident. 12 months may not be (and is frequently not) long enough and you should consider indemnity periods of 18 or 24 months or longer. Whilst you will need to increase the sum insured in proportion, the good news is that generally doubling the sum insured does not double the premium. For more guidance see How to assess a suitable Indemnity Period below

The wrong type (or lack) of cover

This can be anything from not having the right form of BI cover or inadequate cover for losses arising from supplier’s or customer’s premises (particularly if outside the UK), a reliance on utilities or access to your premises. Also, have a look at our ‘Think outside the box’ section.

Do not fall foul of policy small print such as the Material Damage Proviso (for cover to apply under the BI Policy, the damage causing the loss must also be covered by the Material Damage Policy) and a few policies even stipulate the material damage cover must be under the same policy as the BI.

Failure to Review

You need to keep your sum insured and coverage under review (at least annually) to ensure it remains in line with trends and changes within your business, especially if you are expanding rapidly. We often come across businesses that have not properly reviewed the sum insured for years.

The Main Types of Cover

‘Full BI’

covers loss of ‘Gross Profit’ following a reduction in turnover. The insurance provides funds for you to pay ongoing expenses and overheads (other than the uninsured working expenses), as well as net profit.

In addition, ‘additional expenses’ incurred for the sole purpose of avoiding or diminishing a reduction in your turnover will be covered, although for the expenses to be covered, they must pass an economic test, ie they save or bring in at least as much as it reduces your claim.

Increased Cost of Working (ICOW)

can also be known as Additional Cost of Working and is a limited form of cover that may be suitable for businesses deriving most of their income away from their premises or where they can very easily relocate, such as a small office. These policies just cover extra expenses you incur to maintain income, but do not pay for any of the ongoing costs relating to staffing or the premises that have been damaged. These expenses may be for overtime, additional rental or ‘business as normal’ advertising and will be covered if they are reasonable (and ideally cleared with the insurer in advance), but are not subject to the same strict economic test as applies to ‘additional expenses’ cover.

Additional Increased Cost of Working

this is the term usually used for ICOW when it is covered in addition to ‘Full BI’ and is recommended to supplement the ‘additional expenses’ cover. If you suffer a major loss there will inevitably be extra expense that will not necessarily pass the economic test for additional expenses, but is still reasonable in terms of the medium and longer term interest of the business and examples include temporary repair costs or contracting work out to continue to supply customers. As there is no economic test to consider, another advantage is quicker decisions can be obtained from the insurer or loss adjustor.

Other covers

may be relevant to some businesses including Book Debts (outstanding debit balances), Rental Income and Advance Loss of Profits (also called Delayed Start Up).

How to assess a suitable Indemnity Period

The indemnity period should be long enough to put your business back to the same level as you would have been if you hadn’t suffered the loss (including growth you expected to have occurred during the indemnity period).

It is easy to underestimate the time everything can take and whilst 12 months may seem a long time, it may not be long enough, so you should consider the following:

- How long will it take to repair or rebuild your premises? For serious losses architects and surveyors will be involved, there will be a tendering process, local authority requirements are likely to have changed and may involve new planning permission, building regulations, asbestos removal and disability access alterations. Expect delays if your building is old or listed and if you are not the owner, will your landlord make swift decisions?

- How quickly can new machinery be delivered and commissioned? Are there long lead times, especially if it is specialised, custom built or comes from overseas. Is second hand machinery available?

- Are alternative premises available and viable given the nature of your business or do you have the need for a specific location?

- Can you subcontract work to others to fulfil customers’ orders and keep them happy? If not and you lose them be realistic as to how long it will take to win them back or replace them. A longer indemnity period can give you breathing space to regain your market position, particularly if you are dependent on just a few customers.

- Is your business seasonal? If a loss occurs at the ‘wrong’ time, could you miss more than one critical season?

- Don’t under estimate the inconvenience and management time involved with the claims process and getting back on your feet, any other growth plans you had may slip while you deal with the claim.

How to calculate sums insured

Gross Profit is usually defined by most insurers along the following lines:

Insurance ‘Gross Profit’

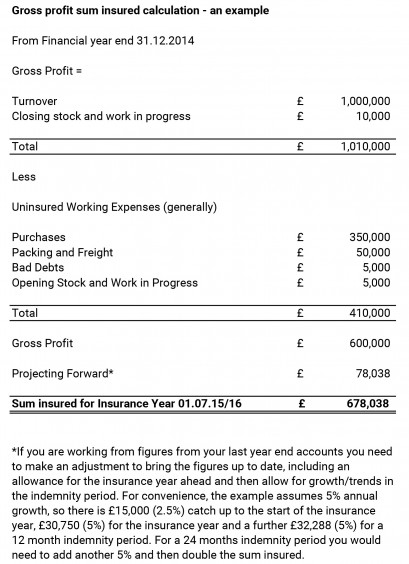

turnover less uninsured working expenses and bad debts, adjusted for the difference between stock and work in progress between the start and end of the financial year. See a working example.

Uninsured Working Expenses

(also known as uninsured variable costs) are those that vary in direct proportion to turnover and are not incurred if you do not make sales, ie the purchase of raw materials and the cost of packing and freight. Some costs such as power and heating may reduce following a loss, but will not vary in direct proportion to a reduction in turnover, so should still be insured. However, some costs such as payments to subcontractors and sales commissions may need discussion before deciding whether they should be insured and in cases where variable costs are significant and savings likely following a claim, consideration can be given to insuring a percentage of the cost.

Accountancy v Insurance

as mentioned earlier, Accountants and Insurers often use a different definition of Gross Profit. Accountants traditionally define Gross Profit as net profit + fixed costs (standing charges), but the problem is this does not include production or manual wages. These wage payments are usually included within the ‘cost of sales’, which accountants treat as variable costs and are not included in their Gross Profit figure.

However, the manual wage roll is extremely unlikely to vary in direct proportion to a reduction in turnover and whilst savings are likely by reducing hours and laying off staff (particularly if there is a prolonged interruption), there will be redundancy costs, notice periods and would you really want to lay off key staff? Most BI policies are therefore set up to cover wages in full (ie they are not treated as uninsured working expenses).

A Gross Profit Policy is suitable for many businesses including manufacturers, retailers and wholesalers, but alternatives on a Gross Revenue or Income basis are available where the whole of the revenue or income is covered without deduction. This basis tends to be used in the professional services sectors where variable costs are limited.

Project Forward

you should work on the basis that a loss could occur on the last day of the period of insurance and include inflation and anticipated growth during the indemnity period. Assuming you are reviewing your sum insured at renewal date, this means you need to project forward at least 2 years (longer if your indemnity period is more than 12 months).

Insurers do appreciate the difficulties in forecasting and setting sums insured and generally offer Declaration Linked Policies with a 33.3% uplift in the estimated sum insured as a means of overcoming the problem, although it is still important to get the estimate as accurate as possible.

Increased Cost of Working

Assessing the sum insured is not an exact science and you should try to gauge the additional costs you may incur if you had to relocate on a temporary basis. Some insurers impose monthly payment limits and if these apply to your policy, you need to assess what you are likely to need in the first few months (when most additional costs are likely to be incurred) and calculate the sum insured from there.

‘Think outside the box’

What could happen to your business?

A few years ago, UK business came under threat from a very unlikely source. The ash cloud from the Icelandic volcanic eruption closed the UK’s airspace and disrupted air transport links. Fortunately it did not last long, however what it did do was open our eyes as to the potential for totally unexpected events to interrupt business.

Why Nsure?

At Nsure, we have dealt with claims from some unlikely sources over the years, an example being a Sussex company whose ‘dumb’ terminals were controlled by their Head Office in Florida. The electricity supply to the Head Office was cut for a number of days following a hurricane. Our client was unable to work until the Florida electricity supply was reconnected, but fortunately a suitable extension was in place on our client’s BI policy.

Consider what type of risks could leave you exposed. Do you have a reliance or dependency with any aspect of your business or risks that are different from the norm? It could be:

- Cyber risks (hacking, viruses etc) to your systems, communications or on line revenue?

- Research and Development Departments.

- Specialist vehicles or transit risks.

- A liability for fines or penalties if you cannot honour contractual commitments.

- Is there vulnerability in your supply chain? Could it be that you are at risk with one of your supplier’s reliance on one of their suppliers? Most BI policies just cover losses from physical damage, but ‘non damage’ can be insured. Could your supply chain be affected by the likes of strikes, political risks or insolvency?

- There any risks specific to your trade sector?

- These should be identified as part of your risk assessments and business continuity planning and you should talk to us about any issues or concerns that you have as most risks can be insured.

As mentioned Business Interruption can be complicated and we have tried to deal with the main issues here, but please feel free to fully discuss your individual requirements with your usual Nsure contact on 01903 520200 or email phil.bristow@nsure.co.uk

Please feel free to download the factsheet here

Example Calculation